Brilliant Strategies Of Info About How To Fix Debt To Income Ratio

Ad see why accredited debt relief is one of the top rated debt relief programs.

How to fix debt to income ratio. Ad compare 2022's top 5 debt relief options. How to reduce your debt to income ratio. Ad compare 2022's top 5 debt relief options.

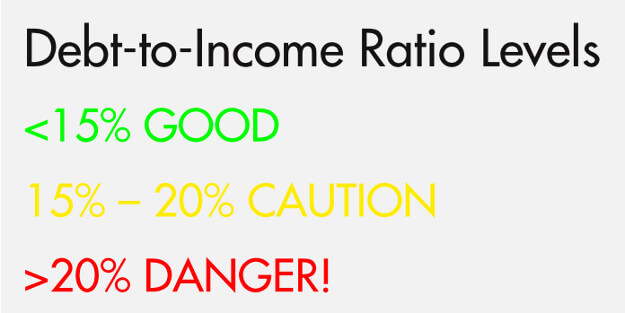

Finding another stream of side income can be helpful in increasing your income (thereby lowering the dti ratio) and fulfilling your debt obligations. For example, fannie mae sets its. Divide the amount of your total monthly debts by your total monthly gross income.

Increase income—this can be done. Different programs come with varying dti limits. Figuring out your dti is a fairly simple process if you know how to do it.

For example, let’s say your recurring debt. Find a source of side income. Multiply the resulting decimal figure by 100 to get your dti as a percentage.

If your dti is too high to qualify for a loan, read below for some strategies to decrease the ratio: Get your free quote today. To calculate the ratio, divide your monthly debt payments by your monthly income.

Be sure to include all income for the entire month. Ad jg wentworth is here to help with your debt consolidation loan. See how much you could save on your debt!