Formidable Tips About How To Check My National Insurance Contributions

You can request a contribution statement by.

How to check my national insurance contributions. Your employer will take it from your wages before you get paid. National insurance remittance card (payment card) employer’s registration form (n.b. Salaries and wages are structured into 16 earnings classes each of which carries an assumed.

You pay national insurance with your tax. This gives you the option to view your state. Check whether you need to make voluntary contributions to fill any gaps in your record.

In the national insurance section of your personal tax account. New business, duplicate) original and photocopy of certificate of incorporation (new business). You might not pay national insurance contributions because you’re earning less than £242 a week.

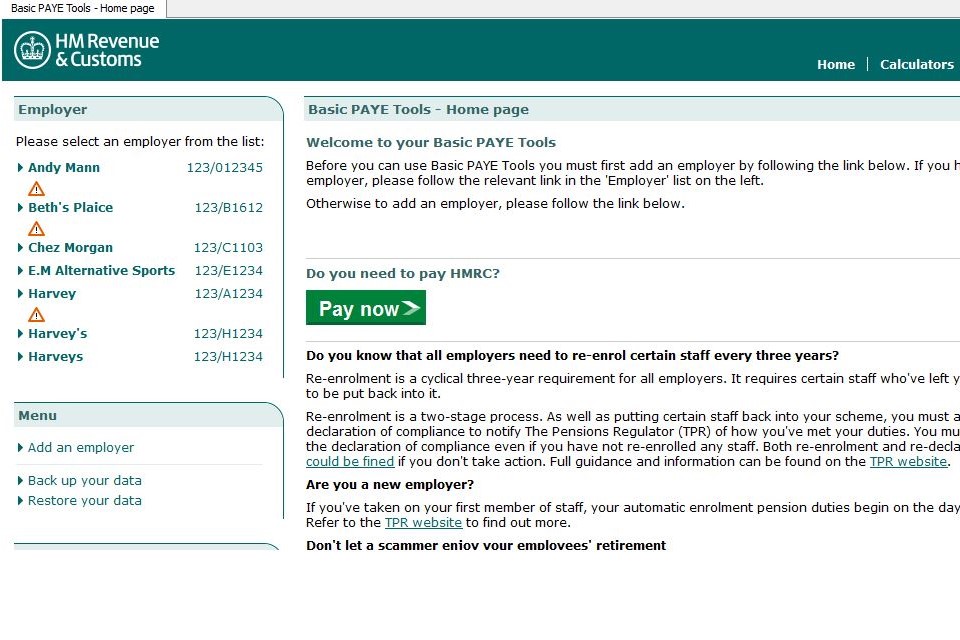

You can check the record of how much national insurance you have paid online, on the gov uk website (under the national insurance section). You will get to the screen below. You cannot request statements for the current.

On letters about your tax, pension or benefits. A contribution is a weekly payment fixed in relation to the wages/salaries of the insured person. How do i find out my national insurance number?

To check your ni contribution record you will need a government gateway account. You will need to sign in using a government. Credits can help to fill gaps in your national insurance record, to make sure you qualify for certain benefits including the state pension.